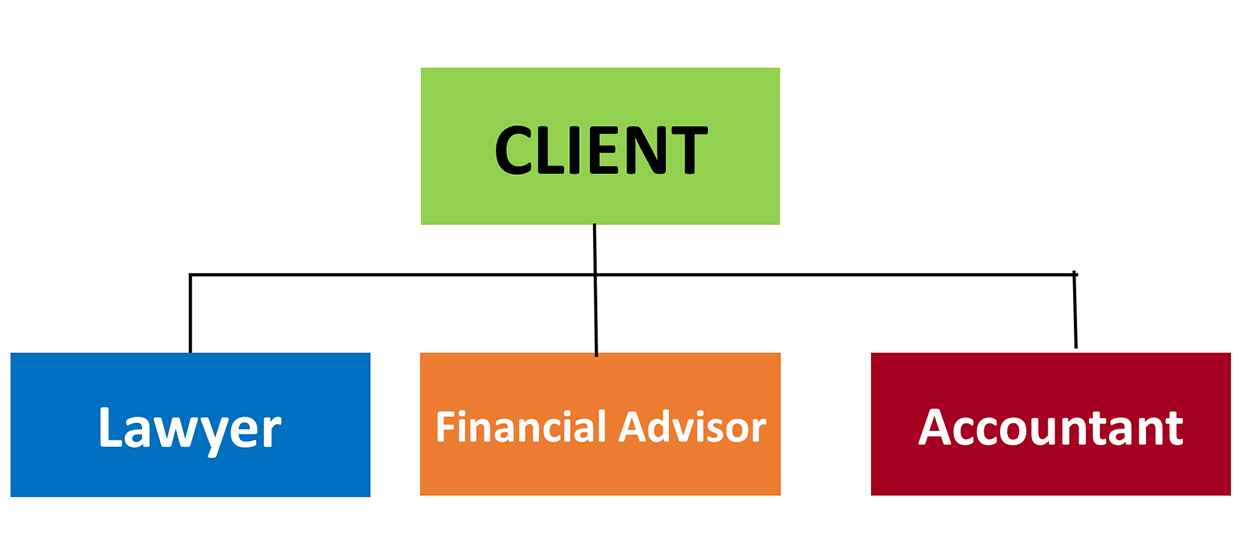

THE ROLE OF AN ACCOUNTANT IN ESTATE PLANNING?

An Accountant can bring his or her knowledge of taxes to the table to ensure you create a proper estate plan. Thanks to this intricate knowledge of taxes, an Accountant will be able to tell you the tax implications of every decision you make. This will help you ensure that your estate plan minimizes the taxes and maximizes the portion of your estate that will be passed down to your beneficiaries. Due to the incredibly high rates of taxation and inflation, it is now more important than ever to have an Accountant by your side to make preserving your estate as simple as possible. You need sound estate planning to preserve the estate and wealth you worked so hard to attain.

THE ROLE OF A LAWYER IN ESTATE PLANNING?

Estate lawyers help their clients determine the specific distribution of their estate. They also provide counsel for those seeking to establish a trust where assets are set aside for a future beneficiary. Drafting wills, trusts, power of attorney and other estate planning documents is a large part of their job

YOUR FINANCIAL ADVISOR’S ROLE IN ESTATE PLANNING

Most financial advisors avoid talking about estate planning with their clients because they may feel they are not licensed legal experts and it should be handled by an attorney. However, your financial advisor’s role in your estate planning is critical and in both your best interests – to ensure their financial advice succeeds and you reach your financial goals. Here are some reasons why your financial advisor should be involved in your estate planning:

- Protection: Having a plan for transferring wealth is just as important as a plan for accumulating it. Most clients spend more time building their assets and not enough time thinking about transferring it, which is an important step to protect your assets from issues such as children/beneficiaries who are financially immature, involved in bad relationships/marriages and/or are exposed to creditors as well as estate taxes. As much as your advisor is concerned with growing your assets and saving for retirement, they should be thinking about ways to transfer your wealth easily at death while finding ways to protect it in the process.

- Coordination: The process of estate planning does not end once the documents are drafted by an attorney and signed by you. There are key steps to take to ensure the success of both your financial and estate plan. Your life and family situation will inevitably change, so it is important for your advisor to be working with your attorney to: (i) update your beneficiary designations; (ii) ensure your estate plan is properly funded and assets are properly aligned with your estate plan; and (iii) review your situation annually and make necessary changes, so you are achieving your financial and personal goals, and your estate plan reflects your wishes.

- Administration: Even if you have an estate plan, it doesn’t mean you will accomplish all your financial and estate planning goals to ensure your assets are properly transferred and protected. An overlooked area in estate planning is the administration of the assets at death. If not properly addressed and accounted for by your attorney and advisor, it may result in unnecessary legal costs of probate and trust administration if assets are not titled correctly or you/trustees are unaware of sensitive election and transfer deadlines.

The goal of working with a financial advisor is to make sure clients can achieve their estate and financial goals in the most efficient manner. Death and taxes are a guarantee, but how much you pay and what happens when you die can be controlled.