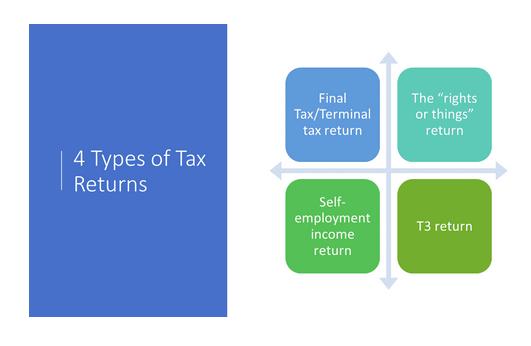

FINAL OR TERMINAL T1 GENERAL TAX RETURN

The final/Terminal T1 return includes all sources of income earned for the period from January 1 of the year of death up until the date of death, including certain accrued but unpaid amounts (such as interest on a GIC), plus capital gains or losses on the deemed disposition of capital property (except where the deceased has a surviving spouse or common-law partner to whom the property will pass on a tax deferred basis).

In general, for the final T1 return, the same filing dates apply as for returns filed prior to death (April 30 of the following year or June 15 for taxpayers carrying on a business). However, the deadline is extended to six months from the date of death if this is later. For example, the legal representative of a person who died on December 20, 2018 had until June 20, 2019 to file the final return.

The advantage of filing one or more optional returns is that tax can be reduced or even eliminated for the year of death. This is possible because the income on each return filed is subject to its own set of graduated tax brackets. In addition, where separate returns are filed, certain personal amounts can be claimed in full on each return. This includes the basic personal amount, the age amount (for persons age 65 and over), the spouse or common-law partner amount, the amount for an eligible dependant, and the amount for infirm dependants age 18 or older (lines 300 to 306 inclusive on Schedule 1 of the federal return).

In general, for the final T1 return, the same filing dates apply as for returns filed prior to death (April 30 of the following year or June 15 for taxpayers carrying on a business). However, the deadline is extended to six months from the date of death if this is later. For example, the legal representative of a person who died on December 20, 2018 had until June 20, 2019 to file the final return.

THE OPTIONAL RETURNS

The following optional returns executors may be filed. The first of these is by far the most common optional return. These are:- The “rights or things” return.

- Self-employment income return; and

- The trust income return, where the deceased taxpayer was an income beneficiary of a testamentary trust having a fiscal period other than the calendar year. [Note: Due to changes to the rules for testamentary trusts, this optional return is effectively eliminated for deaths occurring after 2015].

The advantage of filing one or more optional returns is that tax can be reduced or even eliminated for the year of death. This is possible because the income on each return filed is subject to its own set of graduated tax brackets. In addition, where separate returns are filed, certain personal amounts can be claimed in full on each return. This includes the basic personal amount, the age amount (for persons age 65 and over), the spouse or common-law partner amount, the amount for an eligible dependant, and the amount for infirm dependants age 18 or older (lines 300 to 306 inclusive on Schedule 1 of the federal return).

THE PURPOSE OF A CLEARANCE CERTIFICATE

A clearance certificate does the following:- confirms that an estate of a deceased person or a corporation has paid all amounts of tax, interest and penalties it owed at the time the certificate was issued

- lets the legal representative distribute assets without the risk of being personally responsible for amounts the deceased, estate, trust or corporation might owe the CRA

- The Canada Revenue Agency (CRA) gives a clearance certificate to the legal representative of:

- someone who has died

- a trust or corporation that has wound up or dissolved